Lower the amount of insurance coverage The amount of insurance coverage you need will vary. Limiting those can decrease insurance coverage company sets you back for those who are willing.

Sports cars as well as premium luxury autos, in basic, will become a lot more pricey. Adolescent drivers often tend to cost even more to insure since they are much more most likely to be entailed in a crash as well as use their insurance coverage.

While juvenile drivers had less deaths per capita than grown-up motorists, they had a lot more casualties per mile. This will raise the cost of car insurance coverage.

Where you live will certainly likewise impact your automobile insurance policy costs, not even if local stats affect pricing but also because you might have less options. In the United States, the typical cost of auto insurance for 16-year-old drivers ranged from $660 to $15111 per year. Maine, Hawaii, as well as Indiana were the most inexpensive states typically, while Michigan, Louisiana, and also New York were the most pricey.

The 30-Second Trick For What Is The Cost Of Car Insurance For 16-year-old Driver? - Way

The least expensive vehicle insurance policy companies for a 16-year-old chauffeur ranges from $711 to $7665 per year. This is a typical rate - prices. This price depends on the area and also plan selected. Things to keep in mind when seeking vehicle insurance policy for 16-year-old Although teen auto insurance policy could be expensive, you can generally uncover options that satisfy your spending plan without giving up protection.

This will certainly enable you to compare coverage alternatives and also cost savings, along with identify the average premium in your area for including a 16-year-old to your plan. When looking for a vehicle insurance plan, you should also review available protections, price cuts, client fulfillment ratings, and also monetary strength. In addition to cost, comparing these variables might aid you situate the insurance coverage that meets your requirements.

com could be your answer Worried that you're paying too a lot for vehicle insurance? Check out the factors that figure out the typical cost of your car insurance coverage. It will The original source aid you see if you're paying as well much. Means. com has actually broken down vehicle insurance prices by state and chauffeur demographics to help you with this. insurance.

This can come in convenient if you're seeking a various choice. Auto insurance policy prices vary relying on a variety of variables. It is vital to get many quotes to compare if you are browsing for the cheapest insurance protection. Including a 16-year-old chauffeur to your auto insurance policy coverage will cost you an extra $216 each month usually - trucks.

6 Simple Techniques For Eligibility Information - Tn.gov

Means. com can help you obtain cost-free automobile insurance prices quote. Find out more about Method. com as well as how to obtain the appropriate car insurance coverage by taking your way of life right into account. Why not contact us for a totally free quote? At Means - low-cost auto insurance. com, you break out auto insurance coverage quotes from different business and also even get if you like what you see.

Certain deal, delivery fees & spans vary by electrical outlet. 2 standard tickets only, cheapest complimentary (vans). 0% are likely to advise.

Cars and truck insurance coverage tends to be extremely costly for 17-year-olds, especially when you think about that numerous are still in education and not gaining a permanent earnings. trucks. Why is auto insurance policy much more pricey for 17-year-olds?

The 9-Minute Rule for How Much Is Car Insurance For A 17-year-old? - Wallethub

business insurance accident business insurance insurance companies

business insurance accident business insurance insurance companies

As paying for their automobile insurance policy, new vehicle drivers will need to make sure they have the cash offered to cover the complying with expenses. Acquiring an understanding of the way in which brand-new vehicle driver insurance coverage is computed, and also the kinds of numbers to anticipate, can really help student drivers prepare for the future as well as obtain the ideal vehicle insurance premiums possible. The elements that can be instrumental in lowering cars and truck insurance coverage approximates from day one associate to the car itself( type, worth,

Our How Much Does Your Car Insurance Increase When You Add ... Ideas

mileage, gas mileage) - dui.

Registering your teenager motorist in driving college or a defensive driving training course can lead to financial savings on insurance policy costs. Rating a lot on vehicle insurance isn't very easy at any type of age, yet when you're a young driver, there's an added challenge. Teens have less experience when driving as well as are most likely to enter crashes, so auto insurance for teens has a tendency to be costly. Racking up a fantastic rate

is still doable. How much is vehicle insurance policy for teenagers? When it comes to auto insurance policy for teenagers, young drivers pay greater than their older, much more seasoned counterparts-- regarding$ 169 each month on average, according to our analysis. It comes down to simple stats. Teenagers 16 to 19 are almost twice as likely to experience deadly auto crashes, according to the Insurance Institute for Highway Security (IIHS). Plus, insurance coverage companies don't have as much information to consider when evaluating how accountable a teen vehicle driver gets on the roadway. That indicates more danger to insurance companies, which is why car insurance coverage for teens is much more costly. Teenager male vs. women automobile insurance rates, In our evaluation, we located that male teenager drivers pay about$ 20 more per month than female teen chauffeurs. Teen males are much more most likely to enter accidents. They have actually caused two-thirds of all crashes among teenagers 16 to 19 in the last few years, according to IIHS information. Just how to locate inexpensive insurance coverage for teenagers, The most effective way to discover cheap vehicle insurance for teenagers is to contrast rates from a number of companies. While they all consider teen motorists riskier to guarantee than older vehicle drivers, they do not all upcharge teens the exact same amount. So the only way to see which provides a young chauffeur the most effective price is to contrast quotes side by side. Along with searching, look for teen-specific vehicle insurance discount rates, like the ones stated listed below.

How Car Insurance For 17-year-olds - Average Insurance Costs can Save You Time, Stress, and Money.

One more way to make auto insurance coverage for teens more budget friendly is to minimize their protection levels. But this is risky and also may not also be feasible. For instance, a lending institution may not allow customers to remove crash and also thorough coverage if they have a lease or funding on their lorry. This gives a teen chauffeur the advantage of any discounts their moms and dads get, like a multi-policy discount rate for packing house and auto and also a discount for continual insurance coverage, that teens might not get by themselves. Of training course, adding a teen driver suggests higher prices for moms and dads, to make sure that's something each family needs to take into consideration. There's no regulation concerning when a young chauffeur has to

obtain their own insurance coverage, but for the most part, if they're living separately, spending for their own expenditures, and driving their own lorry, they should probably have their own policy. Ideal vehicle insurance policy for teenagers, Right here are several of the most effective car insurance policy companies for teenager motorists:. With much less experience when driving, crashes are most likely, therefore are various other problems.

Vehicle insurance policy not just provides defense from monetary and legal responsibility, but it can also give extra features like roadside aid. It comes at an added preliminary expenditure, but it will certainly be worth it in the long run if you have an occurrence when traveling. This will aid you discover not only the most effective cost but also the appropriate coverage on your own or your teen chauffeur - vehicle insurance. Once you have the appropriate quote, establish what purchasing alternatives are available. While some companies only enable you to get insurance policy with an agent, others might permit you to obtain a quote as well as buy a policy online. When your policy becomes energetic, there is normally an on-line control panel or mobile app that enables you to.

The 9-Minute Rule for Farmers Insurance: Insurance Quotes For Home, Auto, & Life

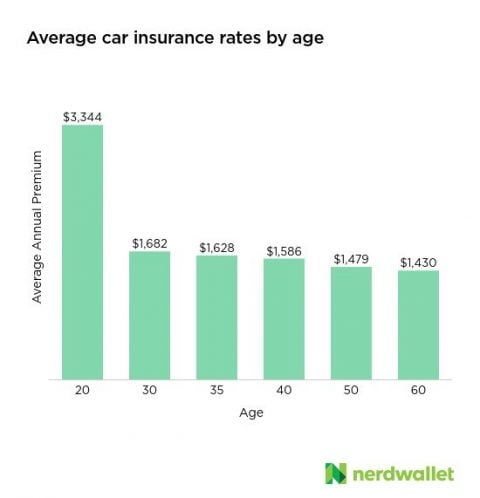

handle your repayments and view claims; in some cases, you can file cases or request roadside support online, but in others, you'll require to call. Regularly Asked Questions How Much Does Automobile Insurance for Young Drivers Price? The price of auto insurance policy is different for everybody as well as depends on a set of details elements, such as your age, gender, driving history, and also credit report. To make up for this absence of experience, teens are typically billed more. Our research study into a selection of the leading automobile insurer discovered the ordinary annual price for 17-year-olds to be$ 5,095, contrasted to$ 1,810 for 42-year-olds and$ 1,497 for 67-year-olds. That indicates 17-year-olds are paying approximately 181 %greater than 42-year-olds. Various other factors that can affect the cost of auto insurance coverage for teenagers are the amount of insurance coverage you get, the kind of cars and truck you drive, as well as just how much you drive each year. Moving violations or crashes on your driving record can additionally enhance prices. Exactly how We Chose the Finest Auto Insurance Coverage for Teenagers Our team evaluated 25 insurer and collected thousands of data factors before choosing our leading choices. Something went wrong. Wait a minute and attempt again Try once again. credit score.

As the parent or guardian of a young chauffeur, you understand it's crucial to have great cars and truck insurance to secure them. You can discover inexpensive automobile insurance coverage for young vehicle drivers without damaging the financial institution.

Nonetheless, if your teenager does have a luxury car, it may be more affordable for them to be on their very own automobile insurance plan, since chances are the insurance costs will certainly be substantially higher

than other cars within your policy. It might also make even more sense for them to acquire their very own policy if either moms and dad has any kind of DUIs or several relocating infractions, as adding a teenager vehicle driver can make the existing plan expense a lot more. Obtaining the ideal insurance coverage that ideal fits your requirements is essential for saving cash on your teenager's auto insurance coverage policy. Discover much more concerning Nationwide's auto insurance protection types today. According to the Centers for Disease Control and Prevention, drivers ages 15 to 19 are 4 times most likely to collapse than older motorists, making vehicle collisions the No. 1 cause of fatality for teens. Even teens with clean mishap documents will certainly face high auto insurance policy prices for a number of years because of their absence of driving experience. Reducing Automobile Insurance Premiums for Teenage Chauffeurs, There are methods to lower car insurance coverage rates for a teen motorist, yet buying a car for the teen and placing him on his very own policy isn't among them. The ordinary yearly price quoted for a teen driver is $2,267.