Without insurance motorist This insurance coverage pays for problems if you or one more covered individual is wounded in a car collision caused by a chauffeur who does not have obligation insurance. cheaper car. In some states, it might additionally pay for home damage.

It varies by state and also depends upon plan stipulations. Underinsured motorist insurance coverage goes through a policy limits chosen by the guaranteed - cheaper auto insurance. Rental reimbursement This protection pays for service expenditures if your car is disabled because of a protected loss. Daily allowances or limitations differ by state or plan arrangements.

You should pay your cars and truck insurance deductible for the case to be full. You do not obtain your case payout without paying your deductible (credit). If you are unable to pay your insurance deductible at the time of your mishap, it is best to wait. Do not send out in your insurance claim to your insurance policy company if you can not pay your deductible.

This consists of fires, floodings, as well as vandalism. There are 2 various other kinds of insurance coverage that utilize deductibles:- PIP covers clinical bills for you and your travelers. Some states require this sort of insurance - insurance.- This kind of coverage shields you when you're hit by a motorist that does not have insurance coverage. This also covers you when their insurance coverage limits can not cover the sum total of damages.

Usually, it functions one of 2 methods: Your insurance policy firm deducts the insurance deductible from your insurance claim payment. Allow's say your claim is approved for $2,500 as well as your insurance deductible is $500.

You after that pay them month-to-month till your insurance deductible is paid off. It helps if you have a long-term company partnership with your auto mechanic as well as can express an honest requirement.

Top Guidelines Of How To Save On Car Insurance: Smart Ways To Lower Your Rate

If you're in a situation where you can't pay your deductible there some things you can do. You need to discover a way to pay your insurance deductible.

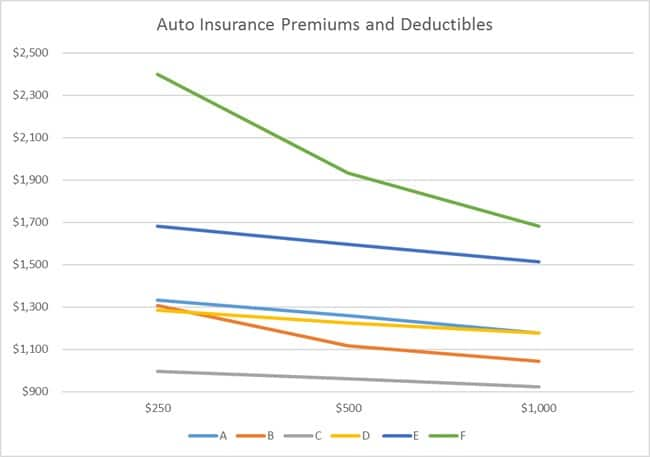

- A couple of states offer the choice of choosing a $0 insurance deductible on detailed insurance coverage. - For any glass damages that can be repaired as opposed to changed, you might not require to pay an insurance deductible. Some insurance provider (like Progressive) use this in cases where glass repair service is possible - cheapest car. Paying your deductible is crucial, allow's find the finest plan for you! You ought to always choose an insurance deductible that you can afford to pay out-of-pocket.

Listed here are various other things you can do to reduce your insurance coverage prices. 1. Shop around Prices vary from business to company, so it pays to look around. Get at the very least 3 cost quotes. You can call companies directly or gain access to details on the web. Your state insurance policy department might also offer contrasts of costs charged by major insurance providers.

It's crucial to pick a company that is financially steady. Get quotes from different kinds of insurance firms (cheaper cars). These firms have the exact same name as the insurance policy firm.

Others do not use representatives. They offer straight to consumers over the phone or through the Net. Don't go shopping by price alone. Ask close friends and also relatives for their recommendations. Get in touch with your state insurance department to figure out whether they offer information on customer grievances by firm. Pick an agent or company rep that takes the time to address your questions.

2. Prior to you purchase an automobile, compare insurance coverage expenses Prior to you buy a new or used car, check out insurance policy expenses. Vehicle insurance policy premiums are based partially on the cars and truck's price, the cost to repair it, its total security document and also the possibility of theft. Several insurance providers use discount rates for attributes that reduce the risk of injuries or theft - cheapest car.

The 5-Second Trick For Comprehensive Deductible - Policygenius

Testimonial your insurance coverage at revival time to make certain your insurance coverage demands haven't altered. Get your house owners and automobile protection from the exact same insurance firm Numerous insurance providers will certainly provide you a break if you buy two or even more kinds of insurance coverage.

Ask about team insurance coverage Some firms provide reductions to drivers who obtain insurance through a group strategy from their companies, through specialist, service as well as graduates teams or from other organizations - cheaper cars. Ask your employer and inquire with teams or clubs you are a participant of to see if this is feasible.

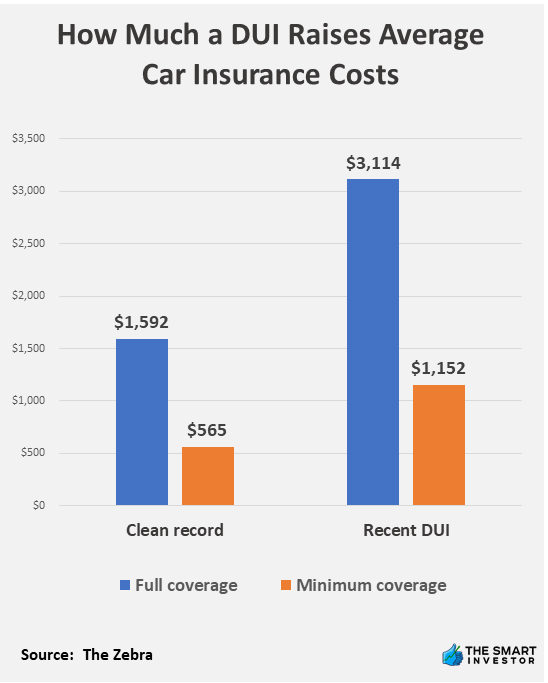

Look for other price cuts Firms offer discount rates to policyholders that have actually not had any kind of accidents or moving infractions Click for source for a variety of years. You might additionally get a discount rate if you take a protective driving program. If there is a young vehicle driver on the plan who is a good student, has actually taken a vehicle drivers education and learning course or is away at university without an auto, you might also certify for a lower price.

The crucial to savings is not the price cuts, however the last cost (cheap auto insurance). A company that uses couple of discounts might still have a reduced overall cost. Federal Citizen Details Center National Consumers Organization Cooperative State Research, Education And Learning, and also Extension Service, USDA.

You have broad accident insurance coverage, If you have wide accident coverage you might have the ability to have your insurance deductible forgoed: If you are much less than one-half in charge of the collision, If you are greater than one-half responsible, the deductible stands and also you need to pay it (auto). If the other individual in the accident is totally liable, that individual's insurance policy will generally pay all fixing fees, including what you would have paid for the deductible2.

cheapest car cheapest car liability cheapest

cheapest car cheapest car liability cheapest

risks cheap car insurance trucks insurance company

risks cheap car insurance trucks insurance company

insure cheapest accident insurance

insure cheapest accident insurance

CDWs do not pay if the person that strike you involves you in a hit-and-run mishap. 3 - low-cost auto insurance. The other motorist is without insurance, In some states you can buy a without insurance driver protection-damage policy (UMPD), which covers you as much as a specified amount if the other vehicle driver entailed in the mishap doesn't have automobile insurance.

Getting The Find Out About Payment Recovery For Car Accidents - Geico To Work

You sue with your insurance policy business to cover the damages to your lorry. credit. When you file a vehicle insurance policy case, you require to pay a deductible before your insurance coverage business covers the remaining prices (auto insurance). Allow's say your car has $5,000 well worth of damages and also you have a $1,000 deductible.

When you have actually paid the insurance deductible, the auto insurer will take over. Review the regards to your insurance plan to make certain you comprehend just how your insurance deductible jobs. insurance companies. You May Not Have to Pay Your Insurance Deductible in Specific Circumstances There are certain situations where you do not have to pay a deductible, including: An Insured Driver Hits You and Is At Mistake If the various other motorist is located officially liable for the crash, then the other chauffeur's insurance company will certainly spend for your repairs and also you will certainly not have to pay your insurance deductible.